As digitalization accelerates, identity verification within the finance, e-commerce, fintech, and regtech ecosystems is no longer merely a security measure—it has evolved into a strategic tool for creating competitive advantage. Veriff’s 2025 Fraud Report takes the pulse of this transformation. The report provides comprehensive insights into rapidly evolving fraud tactics, increasingly stringent regulations, emerging technological innovations, and the need for forward-looking strategies.

A Shifting Fraud Landscape

Synthetic Identities and Deepfakes

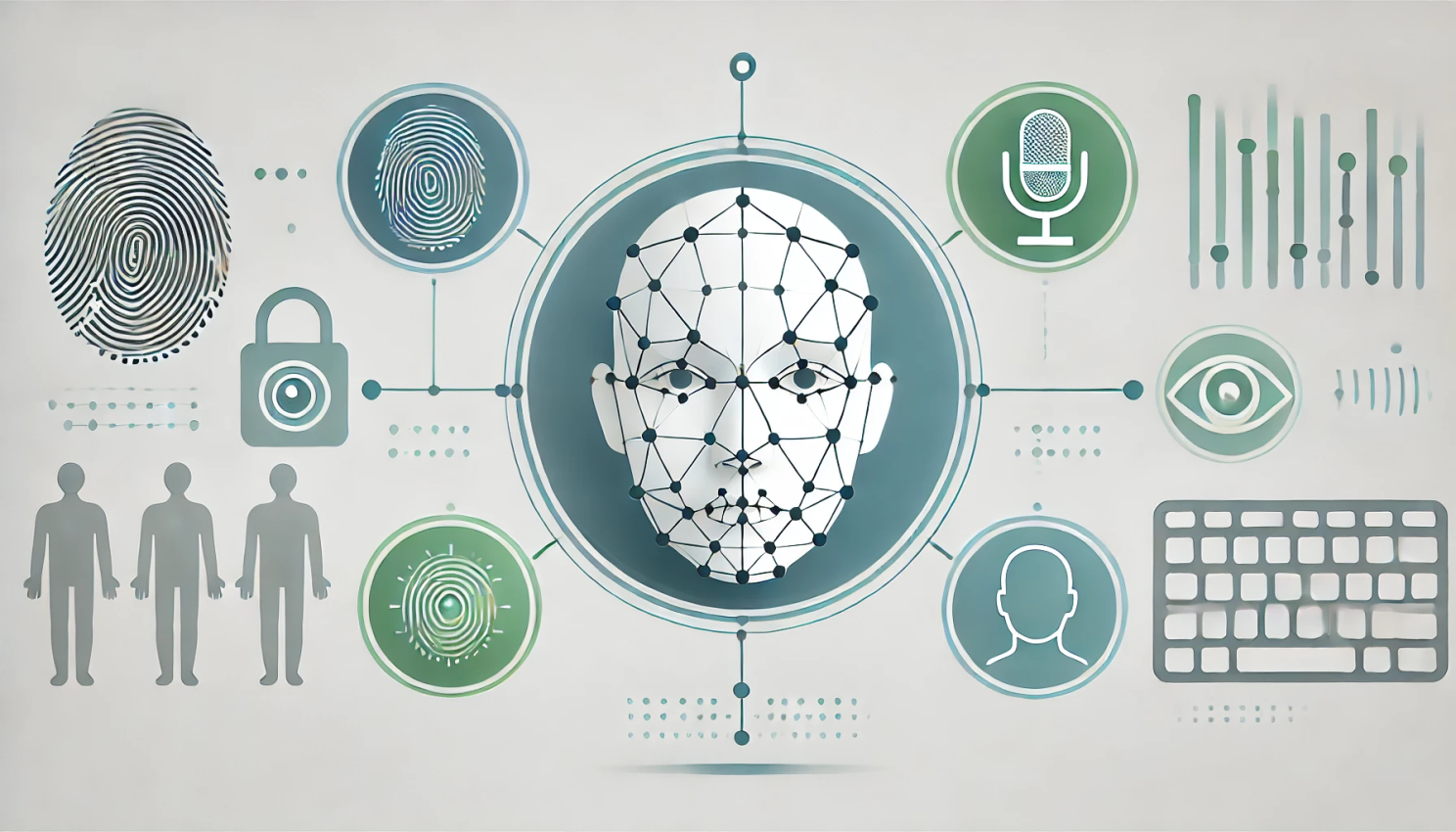

Safeguarding digital identities has become critical. Traditional identity fraud has given way to more advanced methods, including AI-driven deepfake videos and synthetic identities. Attackers now employ machine learning-based tools to generate highly realistic fake documents, faces, and voices, underscoring the inadequacy of legacy verification methods.

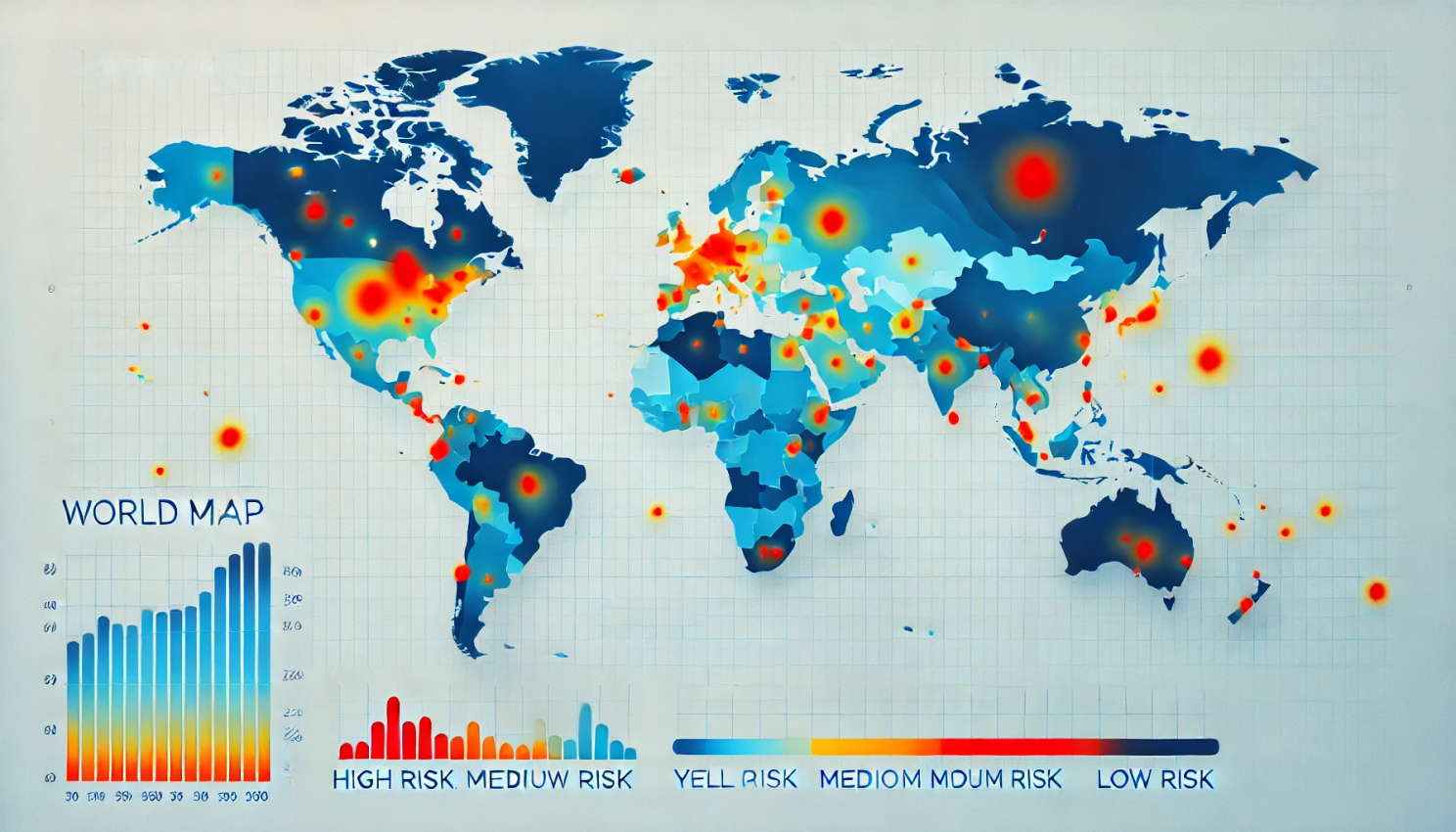

Global Differences, Common Challenges

While emerging markets benefit from rapid technology adoption, underdeveloped regulatory frameworks leave them vulnerable to cybercriminals. In more mature markets, tighter regulations don’t fully eradicate fraud but reduce its overall impact.

Compliance: “Adapt or Disappear”

Harmonized Regulations

As we approach 2025, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations have become core security frameworks across numerous regions. The European Union, Asia-Pacific, and North America now demand greater transparency and ongoing auditability in identity verification processes.

Collaboration and Knowledge Sharing

Regulatory bodies encourage sector-wide cooperation to prevent criminals from exploiting regional vulnerabilities. Through joint efforts, industry-wide standards and the exchange of best practices help diminish fraud risks.

Technological Evolution: AI, Biometrics, and Blockchain

Artificial Intelligence and Machine Learning

AI-driven systems analyze risk in real time by assessing various data points—from device information to transaction behavior—enabling the early detection of anomalies and potential threats.

Biometrics: Face, Voice, Behavior

Biometric technologies have expanded beyond facial recognition and fingerprints. Behavioral biometrics—such as keystroke dynamics and pointer movements—provide a unique personal signature, making it far more difficult for fraudsters to assume another’s identity.

Blockchain-Enabled Decentralized Identity

Blockchain-based digital identity platforms ensure data security, transparency, and decentralization. This reduces unauthorized access and data manipulation, forming a robust defense against malicious activities.

Strategic Roadmap: Proactive, Multi-Layered Defenses

Continuous Verification and Monitoring

Once a single-touch process, identity verification now extends throughout the entire customer lifecycle. Companies proactively evaluate behavior at every stage of user interaction, flagging suspicious changes and halting fraudulent activity before it escalates.

Multi-Layered Security

By integrating various security measures—biometrics, AI analytics, device monitoring, and behavioral assessments—organizations significantly reduce the likelihood of successful attacks. This comprehensive approach strikes the right balance between robust security and user convenience.

Elevating the User Experience Through “Invisible” Verification

Prioritizing security does not have to come at the expense of customer satisfaction. Sophisticated “invisible” verification methods operate seamlessly in the background. Users can transact without undue friction while the system continuously ensures their safety.

Conclusion: 2025 and Beyond

As we move toward 2025, digital identity verification transcends being a routine procedure and becomes a critical factor for long-term success in a digitally-driven marketplace. According to Veriff’s Fraud Report, organizations that balance security with user experience, adhere to global regulations, and deploy advanced technologies like AI and biometrics will enjoy a strong competitive edge.

In a global ecosystem striving for a more secure and sustainable future, proactive and visionary approaches to identity verification are paramount. By embracing these evolving standards, businesses can confidently navigate the challenges ahead and ensure their place in the digital landscape of tomorrow.

For more:

Please contact Nest2Move powered by Sodec Technologies®

References:

• Veriff Fraud Report 2025

• Global AML Trend Analysis Reports

• European Union Digital Identity Regulations (eIDAS)

• Financial Action Task Force (FATF) Reports